42 tax on gift card

PDF New IRS Advice on Taxability of Gift Cards Treatment of ... - IRS tax forms and any unused portion is forfeited). However, Federal tax law does not view giving an employee a turkey or a ham as the equivalent of giving an employee a gift card to purchase a turkey or a ham. A recently issued Tax Advice Memorandum (TAM) in 2004 clarifies the tax law and discusses this issue. Gift Tax, Explained: 2021 Exemption and Rates - Yahoo! Oct 29, 2021 · The IRS allows individuals to give away a specific amount of assets or property each year tax-free. In 2021, the annual gift tax exemption is $15,000, meaning a person can give up $15,000 to as ...

Are gift cards from rewards sites taxable as income? - Intuit The value of the gift cards are taxable income. Please report this under this here: Federal taxes - Wages & income - I'll choose what I work on - Less common income - Misc income 1099-A 1099-C If your screen looks different than mine, it may be because you are using a different version of TurboTax than I am. Gift certificates

Tax on gift card

Are Gift Cards For Employees Considered Tax-deductible? While the expense of the gift card is completely payable by the company, you must pay tax from the worker's compensation for all these incentives. • Employee protection and performance rewards of real property, such as a watch, can be deducted up to $400 per year per worker. Employees do not have to pay taxes on their awards, but they must ... Gift Card Accounting, Part 2: The Rules for Tax This means that on the 2017 tax return, they will recognize these amounts from their sales of gift cards: The outstanding balance of cards sold in 2015 at 12/31/17 = $920. The 2017 tax return for Lesley's Books will show gift card revenue of $14,744, while the actual redemptions are $13,858. Should I tax customers for gift cards? - Avalara More important, however, is that recipients of gift cards are going to be charged sales tax when they use their card -- if the state they're shopping in imposes a tax on the product they've purchased. For example, if you send your cousin in Pennsylvania a Banana Republic gift card, she won't need to pay sales tax on clothing when she uses it.

Tax on gift card. IRS Details the Federal Income Tax Consequences of Gift Cards According to the IRS attorneys, taxpayers who issue gift cards are to recognize income for federal tax purposes when its gift cards are purchased. The IRS attorneys also conclude that taxpayers are not able to deduct the expense until the time that the gift cards are used. Here is an example based on the conclusion reached by the IRS attorneys. Gift cards, gift certificates, and layaway purchases Taxes do not apply to gift cards and gift certificates at the time of sale. Businesses who issue gift cards and gift certificates should report income when the customer redeems the card or certificate. If sales tax applies to the sale, then the seller should collect retail sales tax at the time of redemption. Are Gift Cards Taxable? | Taxation, Examples, & More Is there tax on gift card? Yes, gift cards are taxable. According to the IRS, gift cards for employees are considered cash equivalent items. Like cash, you must include gift cards in an employee's taxable income—regardless of how little the gift card value is. But, there is an exception. Gift Tax Limit 2021: How Much Can You Gift? - SmartAsset Gift Tax and Estate Tax. The federal government will collect estate tax if your estate has a value of more than the federal estate tax exemption. The exemption for 2022 is $12.06 million, whereas it was $11.7 million in 2021. At the same time, the exemption for your estate may not be the full $12.06 million.

Frequently Asked Questions on Gift Taxes | Internal Revenue Service In other words, if you give each of your children $11,000 in 2002-2005, $12,000 in 2006-2008, $13,000 in 2009-2012 and $14,000 on or after January 1, 2013, the annual exclusion applies to each gift. The annual exclusion for 2014, 2015, 2016 and 2017 is $14,000. For 2018, 2019, 2020 and 2021, the annual exclusion is $15,000. How do I report a gift card that is taxable when filing for taxes? June 1, 2019 10:34 AM. You can include the value of the gift card as " Other Income " on your Tax Return by following these steps: Sign In to TurboTax Online. Click " Take Me to my Return ". Click " Federa l" from the left side of your screen. Scroll down to " Less Common Income " and click " Show More ". Click " Start " to the right of Form ... Are gift cards taxable? - Kroger Gift Cards Yes, gift cards are taxable when received when given to an employee from an employer. Employees will have to claim any funds received on gift cards from their employer in their tax return. Employers will also have to pay tax on any gift cards they give to employees. The IRS will expect tax to be paid on gift cards, even in values as low as $5. 2021-2022 Gift Tax Rate: What Is It? Who Pays? - NerdWallet What is the gift tax rate? If you're lucky enough and generous enough to use up your exclusions, you may indeed have to pay the gift tax. The rates range from 18% to 40%, and the giver generally...

Gift of Equity Tax Implications | H&R Block Expires 4/10/2018. Referring client will receive a $20 gift card for each valid new client referred, limit two. Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an H&R Block or Block Advisors office and paid for that tax preparation. Referred client must have taxes prepared by 4/10/2018. Gift tax: Do people have to pay taxes when someone gives them money? If someone gives you more than the annual gift tax exclusion amount — $15,000 in 2019 — the giver must file a gift tax return. That still doesn't mean they owe gift tax. For example, say ... Gifts to Employees - Taxable Income or Nontaxable Gift? The tax-free value is limited to $1,600 for all awards to one employee in a year. Gifts awarded for length of service or safety achievement are not taxable, so long as they are not cash, gift certificates or points redeemable for merchandise. Gifts to Customers Many companies also give gifts to highly valued customers during this time of year. Two-for-One with Tax-Free Gifts for Employees in Germany Cash gifts are taxable. · Non-cash benefits (gift certificates, subsidies, etc.) · Gifts for personal occasions — such as company anniversaries, birthdays, ...

Gift Tax: 6 Ways to Avoid Paying the IRS | The Motley Fool In 2017, you can give up to $14,000 without incurring gift tax. The provision is on a per-recipient basis, so you can make individual $14,000 gifts to as many people as you choose. Because the...

IRS Issues Guidance on Treatment of Gift Cards - The Tax Adviser the sale of a gift card (or gift certificate) if: (1) the taxpayer is primarily liable to the customer (or holder of the gift card) for the value of the card until redemption or expiration, and (2) the gift card is redeemable by the taxpayer or by any other entity that is legally obligated to the taxpayer to accept the gift card from a …

Are Gifts for Your Team and Clients Tax Deductible in the U.S.? The cost of the gift card is fully deductible to the business, but you must withhold taxes from the employee's pay for these gifts. ... The Tax Cuts and Jobs Act of 2017 (TCJA) clarified that awards of tangible personal property cannot include cash, cash equivalents or gift cards, vacation, meals, lodging, theater tickets, sports tickets ...

Tax treatment of gift cards - Henry+Horne For example, if the typical combined federal, state, and local income tax rate is 30%, add that to the Medicare and Social Security rate of 7.65%, and the gift card should be $160.38 (recording it as $160.38 of supplemental income, and withholding $60.38).

Gift Tax | Internal Revenue Service Feb 04, 2022 · The tax applies whether or not the donor intends the transfer to be a gift. The gift tax applies to the transfer by gift of any type of property. You make a gift if you give property (including money), or the use of or income from property, without expecting to receive something of at least equal value in return.

Do I pay tax on a gift card? - Consumer Protection BC While we do oversee certain aspects of gift card laws (like expiry dates and what fees can be charged), we have no authority when it comes to taxes. If you have questions about PST, contact the BC Ministry of Finance: Toll free: 1.877.388.4440. Email: CTBTaxQuestions@gov.bc.ca. For questions about GST and HST, contact the Canada Revenue Agency:

Must-Know Tax Rules for Employee Gift Cards: 2022 Update In fact, any gift card you award to a customer or prospect is non-taxable, whether it's a just-because gift, a customer incentive, a loyalty reward, or a prize won through a promotional contest. Tax Rules for Gift Cards to Employees Gift cards to employees are always taxable, but following the rules doesn't have to be time-consuming or complicated.

Gift Tax: How Much Is It and Who Pays It? - The Balance The first $10,000 in taxable gifts is taxed at 18%, the next $10,000 is taxed at 20%, the next $20,000 is taxed at 22%, and so on. Key Takeaways The gift tax is a tax on the transfer of valuable assets from one person to another. The gift tax rate ranges from 18% to 40%, depending on the value of the taxable gift.

Taxation of gift cards as rewards in Europe - BuyBox 20 Jul 2021 — Gift cards offered to employees are not taxed in France if they do not exceed the threshold of €171 per employee per year. This corresponds to 5 ...

All that You Need to Know about Taxation of Gift Cards in EU A taxable voucher is a voucher that has a specific value and grants the customer the right to a service or product and that also serves as advertising. A ...

US estate and gift tax rules for resident and nonresident aliens Estate and gift tax rates currently range from 18% -40%. The rates are the same whether you are a US citizen, US domiciliary, or non-US domiciliary. Applicable credit amounts are available against gift tax and estate tax for US citizens and domiciliaries, equivalent to $11,400,000 of value in 2019.

Think Twice about Gifting Gift Cards - HR Source Answer: Yes! Gift cards often seem like a quick and easy gift, but you must remember the Internal Revenue Service (IRS) considers gift cards to be additional compensation, and thus, taxable income. Gift cards have value and are essentially cash to a store of some kind. Whenever cash is exchanged, it is a taxable transaction to an employee.

Credit card rewards for purchases of gift cards are ... - The Tax Adviser The number of Reward Dollars paid was based on a percentage (1% or 5%) of the dollar amount of the cardholder's eligible purchases, with no limit on the amount that could be awarded during a year. Eligible purchases included purchases of Visa gift cards, purchases of money orders, and purchases of reloadable debit cards and reloads of those cards.

Gift Tax FY 2021-22: What is Gift Tax? & Exemptions of Tax on ... Gift Tax on Transfers: The gift tax is also applicable on certain transfers that is not considered as a gift. The transfer of existing movable or immovable property in money or money’s worth qualifies for gift tax. Gift Tax Exemptions. Though gift tax is applicable on gifts whose value exceeds Rs.50,000, the gift is exempted from tax if it ...

When buying gift cards, make sure you aren't charged sales tax. The sales tax on the monetary value of the gift card is charged when the recipient ultimately uses the card to make purchases, therefore no state in the U.S. requires retailers to charge sales taxes on the purchase of gift cards.

Using gift cards as a non-taxable trivial benefit You can use giving gift cards or vouchers as a trivial benefit to your advantage. Adhoc gifts that go through payroll may end up getting mixed up in tax and ...

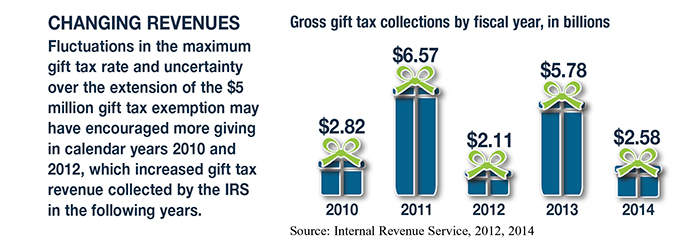

Estate and Gift Tax FAQs | Internal Revenue Service Q. How did the tax reform law change gift and estate taxes? A. The tax reform law doubled the BEA for tax-years 2018 through 2025. Because the BEA is adjusted annually for inflation, the 2018 BEA is $11.18 million, the 2019 BEA is $11.4 million and for 2020, the BEA is $11.58 million. Under the tax reform law, the increase is only temporary.

2021-2022 Gift Tax Rate: What It Is And How It Works | Bankrate Nov 02, 2021 · The gift tax imposes a tax on large gifts, preventing large transfers of wealth without any tax implications. It is a transfer tax, not an income tax. Ordinary monetary and property gifts are ...

0 Response to "42 tax on gift card"

Post a Comment